The expectations of housing companies clearly deteriorated in April 2020 compared to a quarter earlier – according to the survey of GKI and Masterplast. The epidemic caused by the corona virus has crashed the already slowing housing market, so the outlooks have become much more modest. The value of Budapest and Hungarian housing market index of GKI fell sharply on a quarterly and annual basis. According to the respondents, an average price drop of around 9-10% is expected in Budapest and 7-13% in the countryside for the next 12 months.

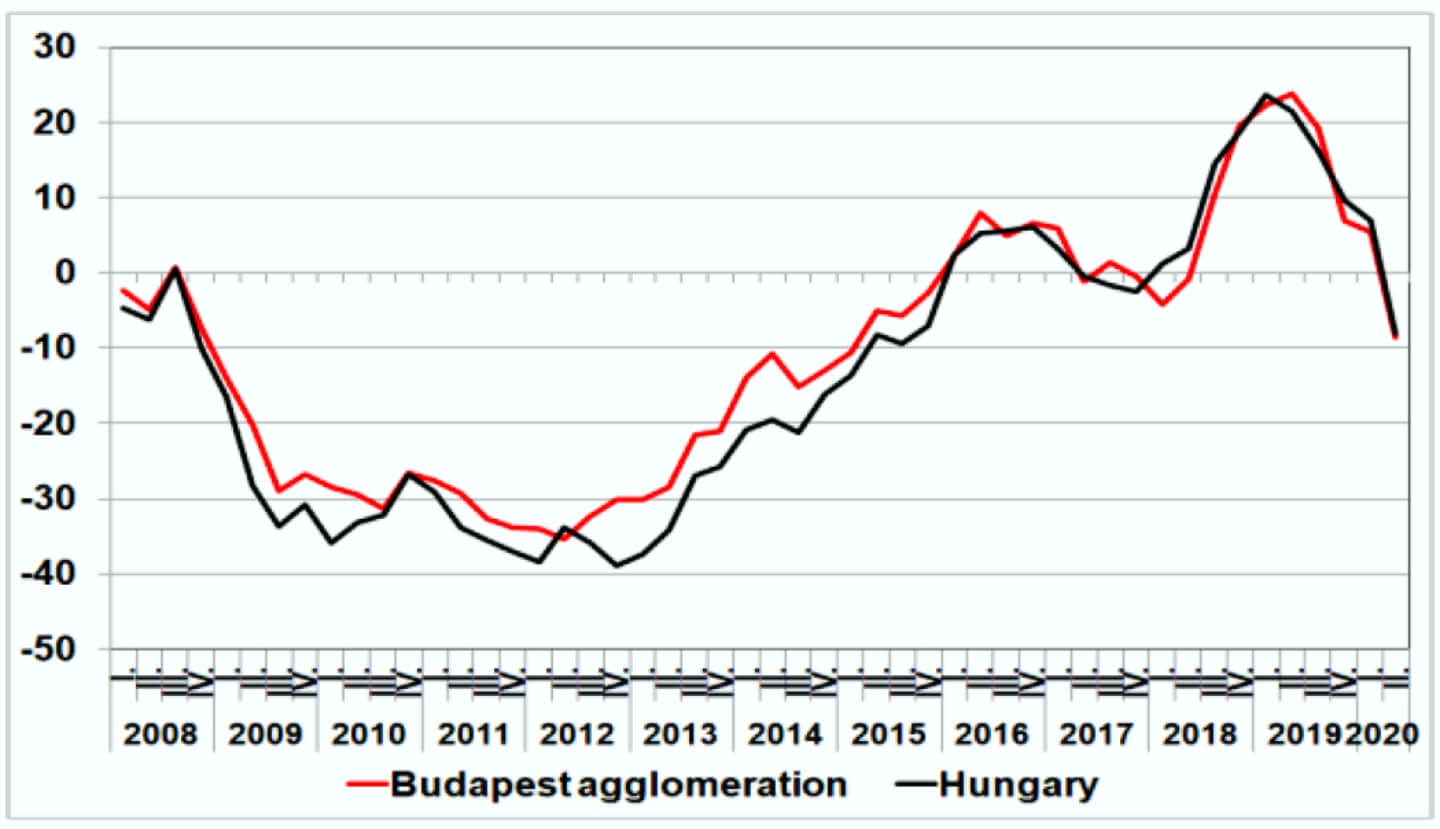

GKI–Masterplast residential market indices for Budapest and Hungary, 2008-2020

Source: GKI surveys

GKI has been conducting quarterly surveys to assess plans, intentions and prospects of real estate companies (developers, agents, consultants and operators) and households concerning the residential market. This survey is carried out with the support of Masterplast Nyrt. Respondents of this survey included 118 real estate firms. The Budapest and the Hungarian residential market indices synthesize expectations for the coming 12 months thus providing an overall view on the prospects of the entire housing sector.

The investment climate has transformed in recent months. Due to accelerating inflation, the yield on super government securities called MÁP + is no longer so attractive. The stock market crash in March, followed by volatility since then, has shaken many investors. In such cases, real estate is usually valued as an investment. On the other hand, unemployment is rising markedly and wage dynamics are declining in many places, even in nominal terms. Therefore, caution and provisioning may be the typical strategy among the households.

In the present survey, real estate businesses’ expectations for the next 12 months have deteriorated markedly from the previous quarter. The Buda side and the center of Pest are still standing (there was only a relatively slight decline here), but a significant deterioration could be registered in the outer districts of Pest. In Western Hungary – with the exception of family houses – the outlook deteriorated slightly for all apartment types, and in Eastern Hungary for all examined segments. From all this, a substantial decrease in the housing market turnover can be projected.

Expected movements in residential prices in Budapest for the next 12 months, April 2020 (Price rise over current prices in percentages):

Non fabricated apartments: -9 (-1.8)

□ Buda green belt: -8 (-1)

□ Other Buda: -8 (-2)

□ Pest downtown: -10 (-2)

□ Pest green belt: -10 (-2)

□ Other Pest: -10 (-2)

Block of flats: -11 (-2)

□ North-Pest: -12 (-2)

□ South-Pest: –12 (-3)

□ Buda: -9 (-1)

Family house: -8 (-3)

□ Pest: -9 (-4)

□ Buda: -7 (-2)

Budapest total: -9 (-2.2)

Results of the previous survey (January 2020) are shown in parentheses. Source: GKI surveys.

Respondents’ expectations of expected house price developments were also significantly worse than in the previous survey. Nationwide, a significant majority expect a decrease in sales prices (75%), 24% expect stable prices, while virtually no one expects a price increase (1%). In the capital, these three rates are 69, 29 and 2% respectively. The expectation of a fall in prices is common in the eastern region (86%), while 14% project stable prices. The overall forecast assumes a 12-13% price drop. In the western part of the country, one-third of survey participants expect stagnant prices and two-thirds expect falling prices. The overall forecast indicates a potential price decline of around 6-7%. There are no significant regional differences in the case of newly built dwellings, a price drop of around 5% is expected everywhere.

80% of the respondents expect decreasing rents in the next one year, and 18% expect stagnation. The expected fee reduction is above 10% in all three regions studied.

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 201,8 million euros in 2022.