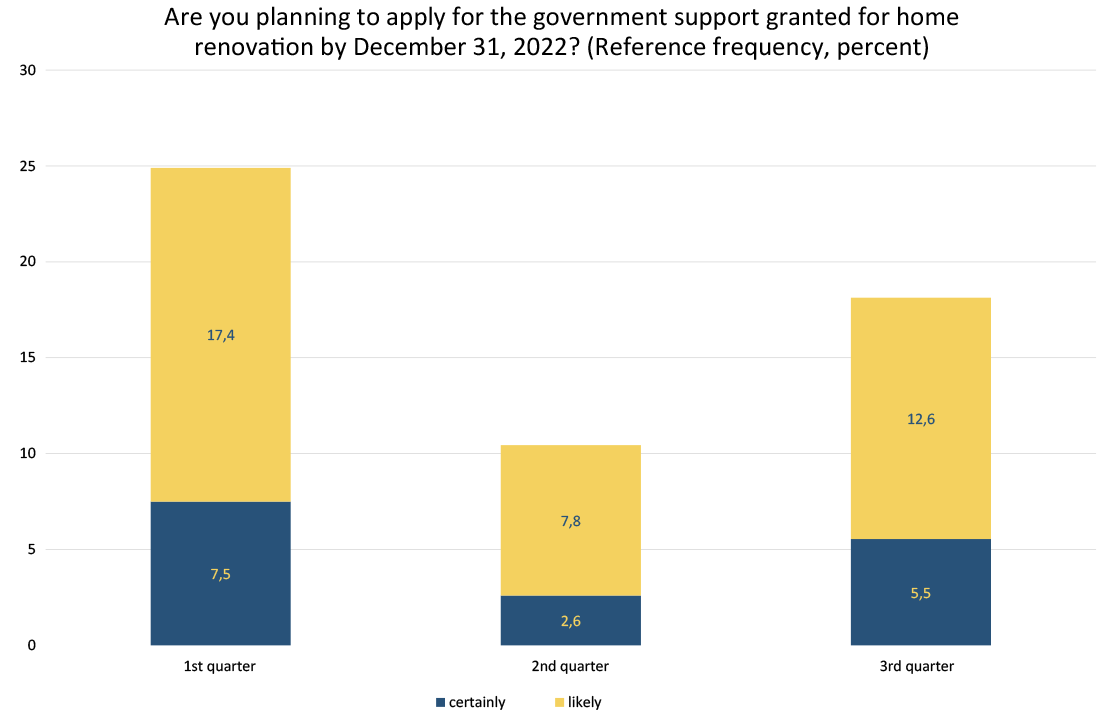

This interest declined significantly in the second quarter, but rose again in the third quarter, although the level of enthusiasm did not return to the level at the beginning of the year, as it become apparent by the August results of a joint study by GKI and Masterplast.

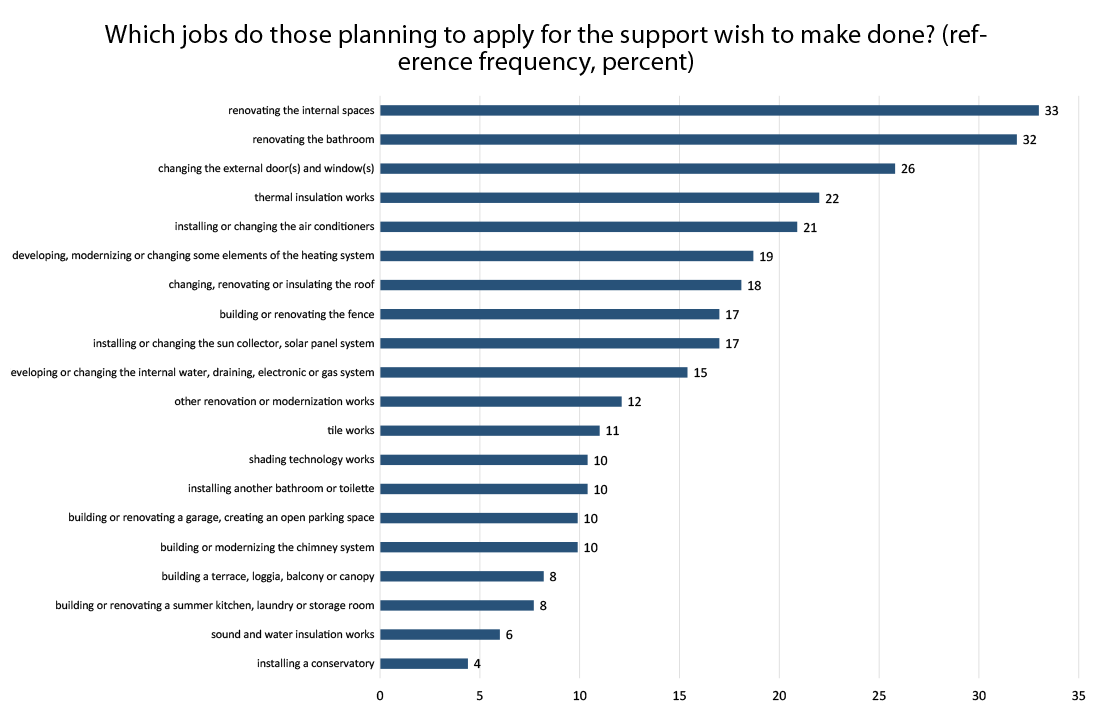

According to the results of the survey of August, by the end of 2022, 5% of the overall households are certain the appeal for the support, while another 13% have intentions to do so. The two most popular goals are the renovation of the interiors and the bathrooms, but a lot of people also wish to do the replacement of the exterior doors and windows alongside some thermal insulation works.

GKI’s surveys aiming to monitor the residents home renovation and modernization plans have been carried out by the assistance of Masterplast from January 2020. The sample of the population surveyed is representative of 1,000 people by gender, age, place of residence, and education.

According to the present legislation, in December 2022, a state subsidy of up to HUF 3 million can be applied for in the framework of the Home Renovation Program for families raising children. 50% of the total renovation amount is recoverable, so quite a high level of own contribution is required to participate in the program, but this can even be financed by loans. The program attracted the interest of many, with approx. 7% of households at the beginning of the year indicating that they were certain to, and 17% would like to participate.

In the second quarter, interest declined significantly, partly due to the difficulties caused by the epidemic and partly due to getting to know more and considering the real possibilities. Data from the most recent survey from August show that a positive correction has taken place since the third wave of the epidemic subsided and the majority of the restrictive measures was withdrawn: in the third quarter, more than 5% of responding households are certain to apply for the government support by the end of 2022. Another approx. 13% have intentions to do so. (Experience has shown that this answer is more of a sign of an interest, considerating the options.)

If these ratios are screened to the whole population, those who are certain to renovate mean 200, while those who have intentions mean approx. 250 thousands families – provided that half of these plans are realized. The reality of the plans and intentions expressed in the surveys varies from family to family, but it has no doubt that although the interest increased in the third quarter compared to the second quarter, enthusiasm did not return at all at the beginning of the year.

Applying for state support is more popular among those living in detached houses – 7% of them said they were certain to, 13% said they were likely to participate. The plans for those living in condominiums are somewhat more modest: 3% of the residents of panel flats will definitely and 14% will probably participate. Among the residents of brick-built condominiums, the same two rates are 3% and 12%.

State support opportunities have aroused plenty of interest among the middle generation: 9% of the families with a household head between the ages of 30 and 49 are certain, and another 18% have intentions to participate in the program. The attention of young people under the age of 30 is slightly above the sample average, while this support is irrelevant for those over 50 and particularly over 60.

The highest attention the Home Renovation Program attacks is actually expected among those living in small towns – the proportion of those who are certain and have intentions to participate are 8% and 12%. The intentions of people living in Budapest and in the villages is roughly equivalent to the sample average. (Since the Family Allowance Scheme was extended to villages, people living in smaller settlements could also receive help to renovate or modernize their homes.) Among the statistical regions, the highest activity is expected in Central Transdanubia and Northern Hungary.

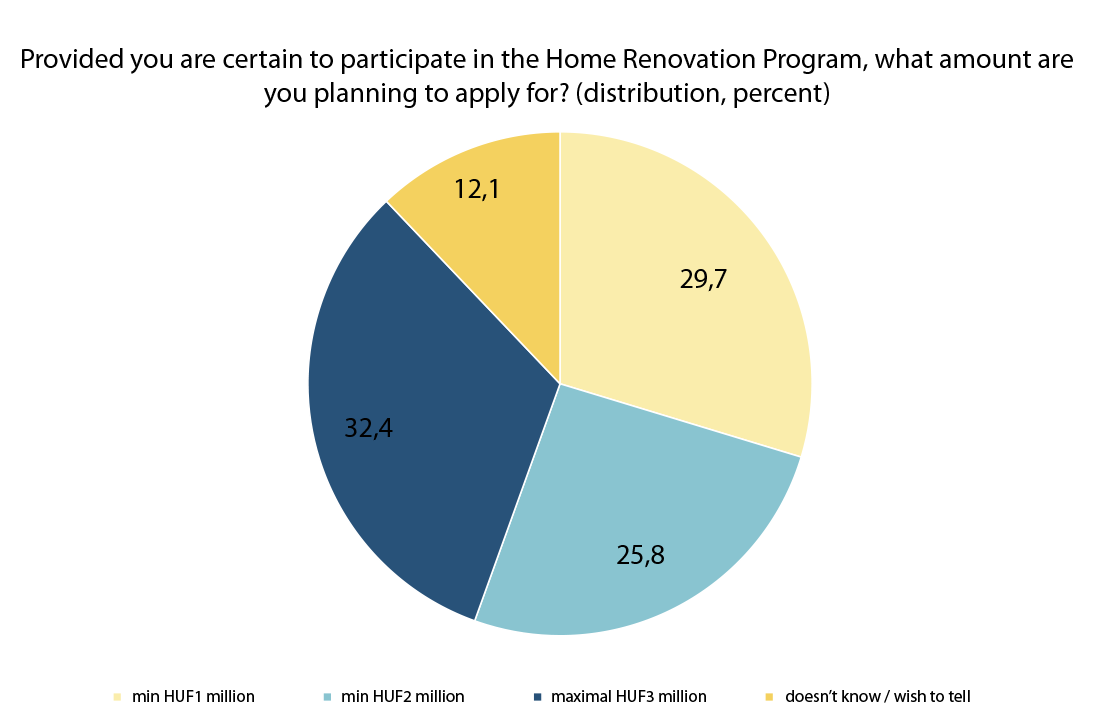

About a third of those planning to apply for the state support would like to use it in the maximum available level, while one fourth of them would be satisfied with HUF 2 million, 30% of them with an amount around around HUF 1 million. In the light of these, the average amount of the application is HUF 2.1 million, and, including the self-sufficiency, the project value of HUF 4.2 million could be enough for major renovation works. The average amount taken up this way remains the same as in first quarter.

The two most popular goals are the renovation of the interiors and the bathrooms (the former means the replacement and renovation of the interior wall, floor and ceiling coverings, as well as their painting and wallpapering). These tasks are considered to be performed by one third of the respondents. The need to renovate bathrooms arises in almost half of condominiums, while a quarter of those living in single-family homes are considering such modernizations. A general need to renovate interiors is experienced.

About a quarter of those surveyed (but one in three of those living in a panel apartment) are considering replacing their exterior doors and windows. Basically, one in five respondents would like to make thermal insulation work carried out (almost one in three family houses and one in six condominiums may be affected) and have an air conditioners installed, but the reference frequency of roof renovation (which is obviously applicable to detached houses) and modernizing the heating system does not lag behind these. The installation of a solar collector and solar system is really popular among those living in family and panel houses.

For those living in detached houses, in addition to the abovementioned, the construction and renovation of the fence (the reference frequency is 23%), the design of the pavement, and the construction and renovation of the garage (17-17%) are much more important than average.

Residents of brick-built condominiums have a particularly high demand for the installation or replacement of air conditioners (26%) and the renovation of water, sewer, gas and electricity internal networks (the reference frequency is 19%).

Carrying out shading works is more popular among the residents of panel flats (16%).

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 201,8 million euros in 2022.