A lower level of uncertainty appears among dwellers of apartment buildings, but not among detached house owners. Once again, residents of smaller municipalities have the biggest renovation plans.

GKI conducts a survey every quarter to reveal residential home renovation and improvement plans, intentions, and prospects. Since January 2020, the survey has been sponsored by Masterplast Nyrt. This sample of 1000 people (surveyed in April 2022) is representative as regards characteristics like sex, age, place of residence and qualification.

There is enormous demand for renovating and modernising residential homes, therefore there is governmental support available to the majority of the population in order to support such plans. Before the general elections, the leading governmental party promised to extend the deadline of this support. If the deadline were extended, it would boost further renovations and modernisation.

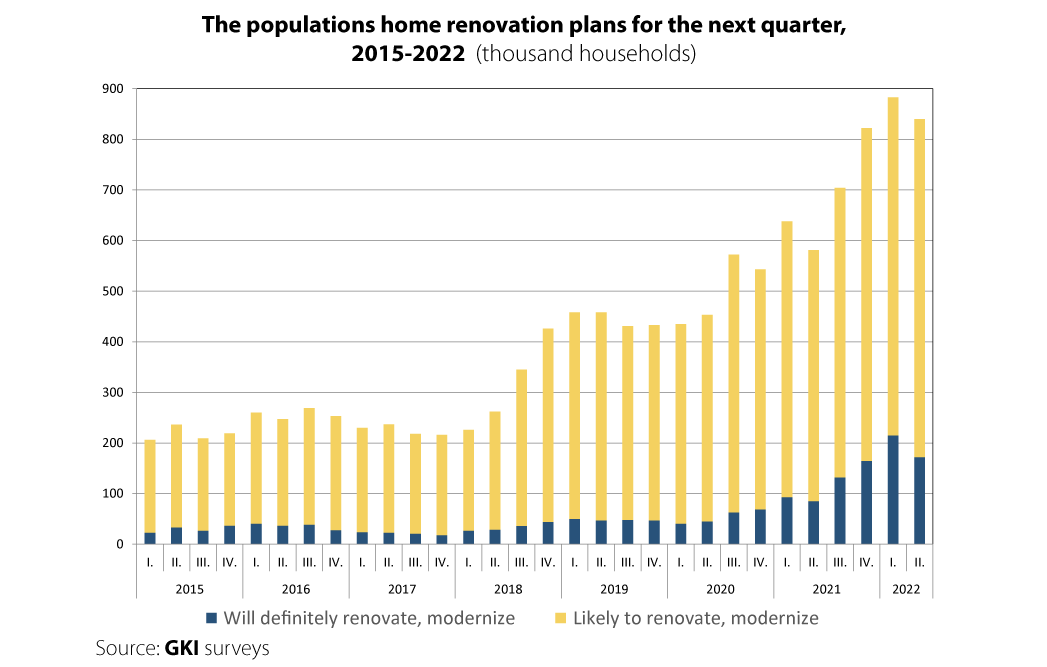

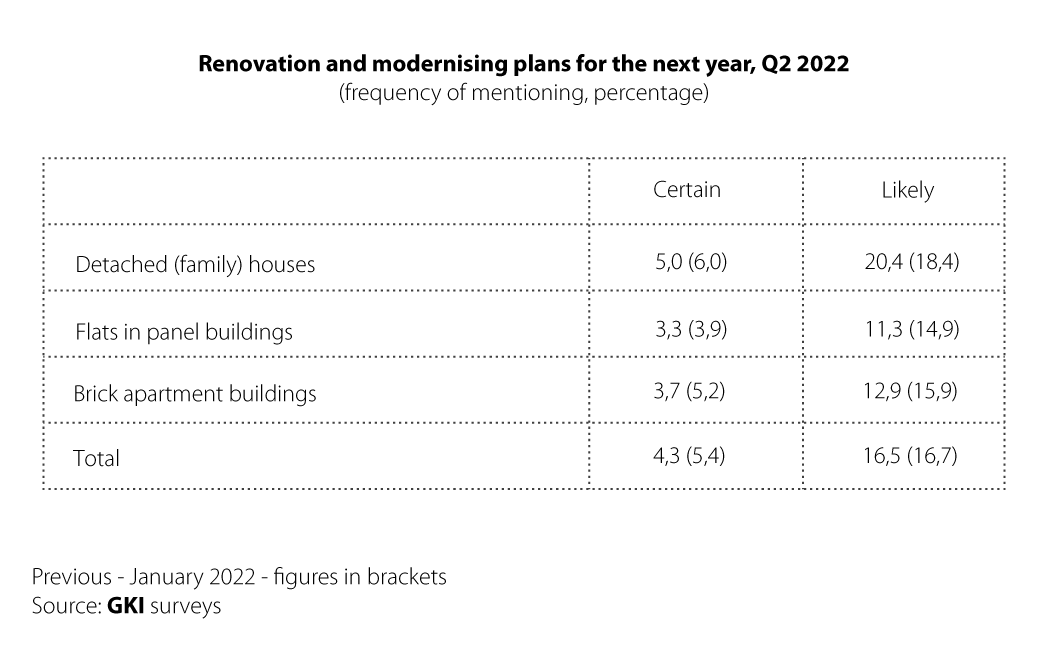

Despite some setbacks, the number of households that wish to spend a larger amount of money on their homes has basically increased in the last three years. This year, the results of the second quarterly survey suggest some decline, primarily in the number of those who were certain to renovate or modernise. 4.3% of the households surveyed in April 2022 said that they are certain to spend a larger amount of money on their homes next year, whereas 16.5 % said they are likely to. If all these plans are implemented, then – using survey results for making conclusions about the whole population of Hungary – approximately 840 thousand homes will undergo minor or major improvement by the end of 2022. This figure is 44,000 smaller than the survey result of the previous quarter and essentially equal to that one seen half a year ago, but it is 260,000 greater than the figure received a year ago. There has been a slight decline in determination in the last quarter. This January, one in four people considering renovation said that they were certain to implement their plans, however, this survey shows that now only one in five is certain to do so.

Traditionally, the residents of detached houses are the most willing to renovate or modernise their homes. The second quarter of this year was not any different – according to plans, 1 in 4 houses might undergo some minor or major maintenance work in the following year. Dwellers of apartment buildings have more modest plans and, compared to the previous quarter, there is significant uncertainty hanging over them: 14-15 % of families living in panel buildings, and 16-17% of dwellers of brick flats could be affected, whereas in January, nearly 19 and 21 % of them respectively had home renovation plans.

In the distribution of residential renovation plans, we can basically see an inverted municipal slope. Residents of the capital city and towns with county rights were the least willing to renovate or modernise their homes, as 18% of people living there set out plans to do so. A quarter of small town residents, while a third of small municipal residents are planning to spend a larger amount of money in the following year. Funding by the family housing programme (CSOK) available to village dwellers might contribute to the big plans of small municipal residents.

Earlier surveys showed that mostly people aged between 30 and 49 had plans to renovate and modernise. According to the latest survey, the number of young people under 30 with such plans has not only reached, but also exceeded their number. People over 49, and especially those over 59 have continued to report about their more modest plans.

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 201,8 million euros in 2022.